Mortages are an essential component of almost every real estate sale, and without one you would not be able to come up with the large sum of money that is needed to buy a home. Even though they are such a critical part of the deal, most people aren’t even sure how mortgages work in Canada.

Disclaimer: I am not a qualified expert on mortages and I am not providing advice. Always consult with a licensed mortage expert before making any decisions.

What Are Mortgages?

A mortgage is a loan that is used to be able to fund the purchase of a home. Most people do not have the money to pay for the entire amount of a home out of their pocket. This means that they need to borrow the difference between the price of the house and the amount that they have to use as a down payment. This amount is usually borrowed from a bank or another financial institution and paid back regularly over a long period of time (with interest).

There are different types of mortgages: some with fixed interest rates, some that are variable, some that allow you to make extra lump sum payments and some that don’t. The type that you get depends on the lender that you work with and your specific needs.

Down Payments

You won’t be able to get a mortgage unless you have enough money saved to contribute a substantial down payment. This amount is paid up front when you purchase a home, with the rest coming from the amount that you borrow. Generally, lenders like buyers who can pay 20% of the price of the home as a down payment. Lenders will still give mortgages to those who can’t come up with this much, but down payments under 20% mean that you will also have to pay mortgage insurance on top of the principal amount borrowed and interest. This is to protect the lender from those who can’t pay back what they borrow.

Pre-Approval

This is a very important step in the home buying process. Getting pre-approved for a mortgage means that the lender takes a look at your circumstance and gives you an idea of the most they would be willing to lend you. This is not a promise to lend you the money, but it does tell you what they will probably give you and at what interest rate. Once you receive a pre-approval, you know that you are in good standing to receive a mortgage and can start looking at houses in the appropriate price range that you’ve been pre-approved for.

This is absolutely essential to do before looking at homes, because without a pre-approval you have no idea what you can afford or if a lender would even be willing to give you any money at all.

What Do You Need To Be Approved For A Mortgage?

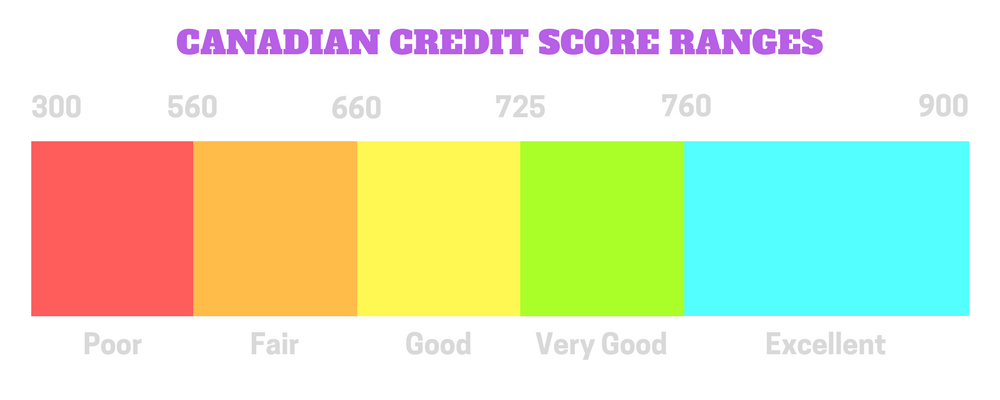

Lenders look at a variety of things when deciding if they should lend money to someone. They confirm your ID and address, check your employment status, history and income, search for any debts you may have, and look at your credit history and score. Credit history is a big factor in mortage approval, since it shows how well you are able to pay back the money that you owe on time.

How Long Do Mortages Take To Pay Off?

The length of time that it takes a person to pay off their entire mortage (including interest) is called the amortization period. The common range is between 10 and 25 years, and your monthly payments will depend on how long you choose. A longer amortization period means that you pay less each month, and vice versa. It is important to note that a longer time period for paying back your loan also means more interest accumulated.

A mortage term is like a contract that is renewed periodically until your amortization period is over and the entire mortage has been paid back. These terms usually range from a couple of months to 5 years (or longer), and when they are renewed you can re-negotiate the details and your interest rate may change according to current rates. How long you pick for your term depends on your situation and the interest rate at the time. If interest rates are high, you may want to be able to re-negotiate in the near future when they drop.

Fixed vs. Variable Interest Rates

Fixed rates mean that the interest that you pay does not change throughout the term of the mortgage. This also usually means that the interest rate is higher than that of a variable rate.

Variable interest rates are changed by the lender according to variations in market rates. These are usually lower than fixed rates due to the unpredictability of what will happen in the future.

There are also hybrids of the two which structure part of the loan with a fixed interest rate and the rest as variable.

Want To Know More About How Mortgages Work In Canada?

If you have more questions about mortgages or want to ask about your specific situation, you should contact a professional or check here. If you are looking for someone to speak to, feel free to contact me and I can refer you.

If you are interested in buying a home and want more information and tips, check out my Buyer’s Guide. Please do not hesistate to contact me with any questions that you may have!

My personal cell: 289-675-4882

Email: brad@braddornellas.com

Pingback: Tips For First Time Home Buyers In Ontario | Brad D'Ornellas